Giving More Through Securities

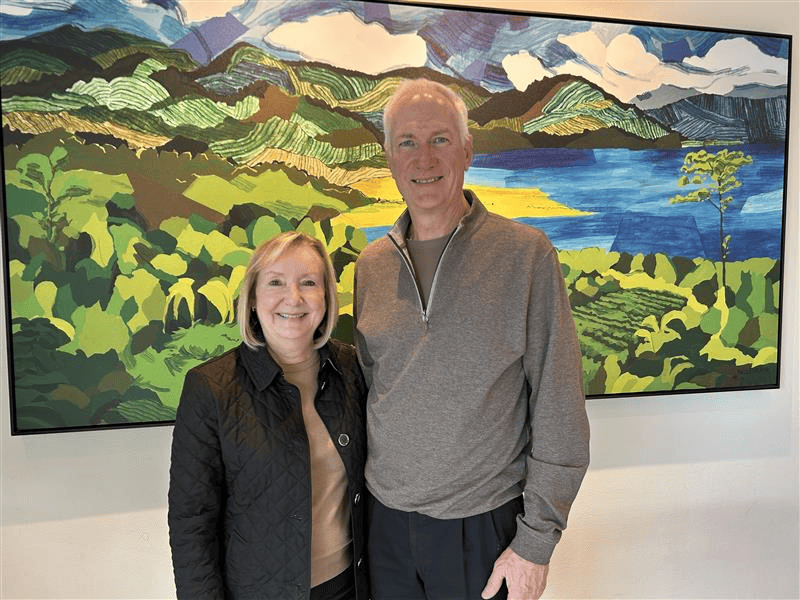

Brian and Jan’s Story, and the Benefits of Donating Stocks and Securities

Giving back has long been a part of Brian and Jan Pritchard’s financial plan, but the Kelowna retirees were surprised to learn how switching up their donation strategy would have such a positive impact on their donation and their personal finances.

Having lived and worked in the Netherlands, Edmonton, and New Orleans, they had long planned on retiring to Kelowna because of its hospital, airport, and of course, the many other benefits of living in the area. Now after nine years of making Kelowna their home, they’ve supported the KGH Foundation for some time.

“We are amazed and highly impressed with the level of advanced care available at KGH,” shares Jan, former medical lab technologist. “It’s important to support health care locally, as we will all rely on the hospital at some point. Brian and I look at our donations to the KGH Foundation as an investment in the future.”

The couple donates to the KGH Foundation every year and has even left a gift in their Will to support the charity. After a meeting with their financial planner, Brian and Jan were surprised when they recommended a gift of stock instead of their annual cash donation.

“Our financial planner brought up the idea of donating a gift of securities as the preferable option after we talked about how much we were planning to give,” shares Brian, retired engineer for Shell. “Prior to this, we assumed stock donations were only meant for those giving a million dollars or more, so we had never considered it.”

Their planner explained how this option would increase their personal tax deduction, as it removes the need to pay capital gains taxes, while still maximizing their donation.

“It was a shock to learn how beneficial this was for our bottom line, and how extraordinarily easy it was,” Brian recalls. “It took 5 minutes! We only needed to complete a form supplied by the Foundation, sign a few documents, and the broker knew how to take it from there. Donating a gift of stocks sounds as though it would be a daunting task, but it ended up being quite simple.”

“Donating securities was a win-win,” Jan adds. “We got a bigger tax deduction, and the KGH Foundation received a larger donation. We are so happy that we could increase our impact on local health care and would recommend this method to anyone.”

Maximizing Your Impact with a Gift of Securities

This giving season, consider making a gift that will bring world class health care closer to home and possibly save you in tax costs as well. Gifts of securities are gaining popularity as a tax savvy and easy way to support charity as they can reduce or even eliminate capital gains tax while also lowering your taxable income.

This way you save more while increasing your donation.

If you are considering a gift of stocks, ETFs, mutual funds, or bonds over the holidays, now is the time to meet with your professional advisor to determine the best plan for you and your portfolio. To ensure a 2025 tax receipt, donations of shares must be completed by year end. Mid-December is the cut-off for many brokers.

Any donation to the KGH Foundation, no matter the size, will make a positive impact on the health of our hospital and our community.

Because giving changes everything.

To learn more about gifts of securities, and to view the Foundation’s easy online form to help you through the process, visit the KGH Foundation website or reach out to Robert Hamanishi, the Foundations Director of Planned Giving, at robert.hamanishi@interiorhealth.ca or 250-862-4300 ext. 27011.