Donating Stocks & Securities

Gifts of securities are an impactful and tax-advantaged way to give.

MAXIMIZING YOUR IMPACT

More Health, Less Tax

Because capital gains are not taxed on donated securities and mutual fund shares in most cases, giving this way allows you to give more. As an added bonus, your tax credit will increase too. Ask your advisor if changes to the tax act, effective Jan. 1, 2024, will effect you.

For more information, please view the following Gift of Securities Forms. There are two separate forms, one for those using self-directed online investment platforms, and one for those using a traditional broker.

FAQS

The short answer is with proper planning, you’ll realize even more tax savings than you would with a gift of cash. Not only can KGH Foundation issue an official donation receipt (that can be claimed to save taxes) for the value of the publicly traded shares or mutual funds you transfer, you won’t have to pay tax on any capital gains realized. In other words, you get twice the advantages you would with a gift of cash.

The ability to accept securities opens the door to more gift givers, as well as larger gifts, to support our work. Most gifts of securities are larger than the average cash gifts, and the higher tax savings ultimately make charitable gifts less costly, so donors are able to give more.

Usually, a securities gift will be done by way of electronic transfer from your account to KGHF’s account. You will need to fill in the necessary form that will instruct your bank or investment firm to send your gift.

Tax planning is important here, including who should make the gift (for example, you or your company). It’s also important to be sure that the shares or mutual funds you want to transfer will qualify for the incentive (for example, not held in an RRSP, RRIF, or TFSA). Since the incentive relieves tax on capital gains, choosing securities with larger capital gains is typically a good approach.

No, you don’t have to use it only in the year the gift is made. Under current tax rules, gifts made in life (meaning not in a will) can be carried forward for up to five more years. Keep in mind there is no substitute for good tax advice, and as with most tax incentives, there are specific rules and conditions to follow.

You can make losses work for you. If you own stocks that are currently in a loss position, donating these shares in-kind may improve your financial picture. Provided your investments meet CRA-approved cost basis methods, this scenario may also work for donations of cryptocurrencies.

You can also sell an investment whose value has gone down, create a capital loss, and donate the cash – with no taxes payable on that investment and the added ability to reduce your overall tax bill with a charitable donation deduction. For incorporated clients, extra care is needed to first clear out any balance that may be held in the corporate Capital Dividend Account (CDA).

Capital losses can be carried back up to three years and carried forward indefinitely to offset capital gains realized on specific assets including non-registered investments, recreational and rental properties, and private company shares.

IN COMMUNITY

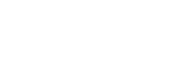

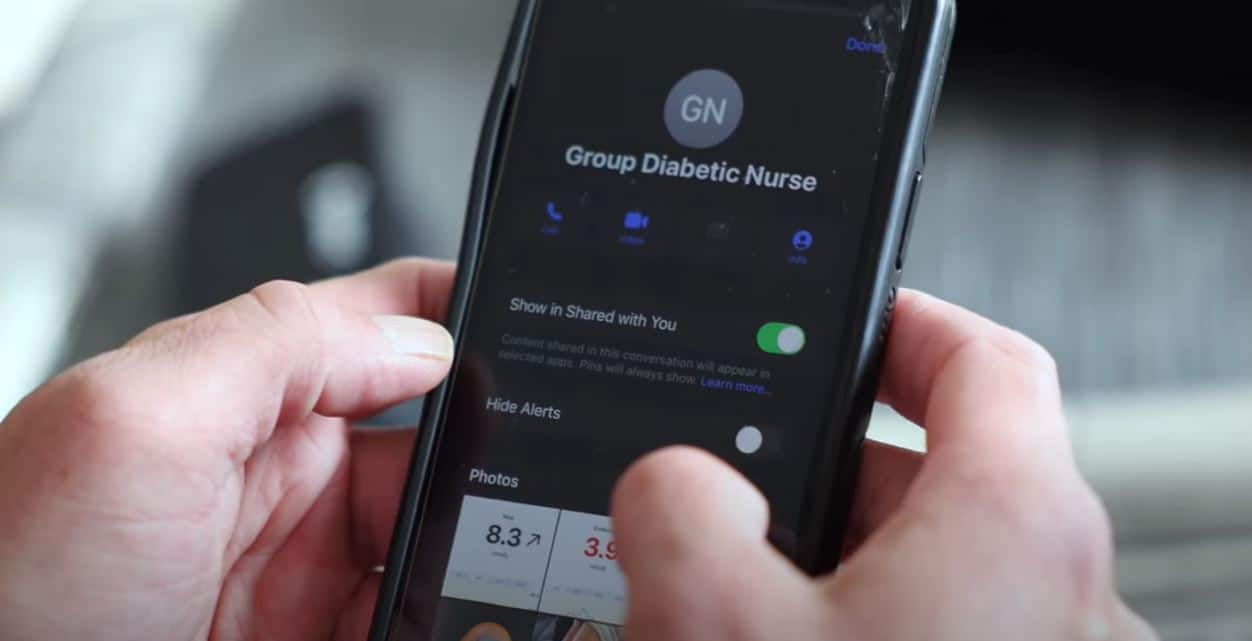

Transforming Diabetes Care

An innovative initiative to support Type 1 diabetes made possible by donors is transforming care for children across the region.

New Horizons

Thanks to an innovative program at Kelowna General Hospital (KGH), dialysis is evolving into something more engaging and uplifting.

Central Monitoring System

Central Monitoring Systems help streamline hospital care by displaying essential patient data in one central location.

ADDITIONAL RESOURCES

Leadership gifts have created opportunities that wouldn’t otherwise be available within traditional government funding models.

POINT OF CONTACT

Planned Giving

OUR OFFICE

Come see us in person!